Wall Street's AI Bull Run: A Critical Juncture

US stock market closed 2024 with historic gains, led by AI-driven tech surge. With Nasdaq up 28.64% and Nvidia gaining 171%, analysts weigh market sustainability amid high valuations and AI sector concentration.

The unprecedented rally in US stocks during 2024 marks a pivotal moment in market history. The remarkable performance, particularly in the technology sector, raises important questions about market sustainability and concentration risk heading into 2025.

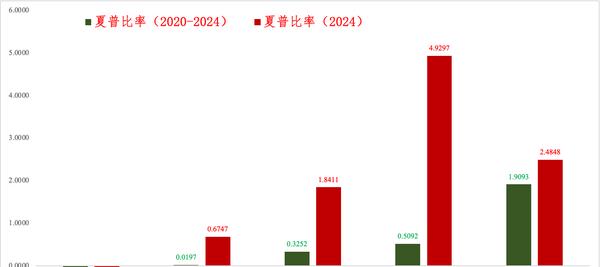

The market’s impressive gains were heavily concentrated in what Wall Street dubbed the “Magnificent Seven” - Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and notably Nvidia. These tech giants accounted for nearly a quarter of the S&P 500’s total market capitalization by year-end, with Nvidia’s staggering 171% annual gain epitomizing the AI-driven enthusiasm.

This concentration presents both opportunities and risks. The tech sector’s dominance reflects genuine technological breakthroughs in artificial intelligence, but the extreme market concentration in a handful of companies mirrors concerning historical patterns. The current market dynamics bear some resemblance to the late 1990s tech bubble, though with more substantial earnings supporting current valuations.

Several structural factors warrant attention. The Federal Reserve’s monetary policy stance remains crucial, as high interest rates could challenge growth stock valuations. Additionally, the AI sector faces potential headwinds from infrastructure constraints and increasing competition. Market veterans note that periods of extreme return concentration historically tend to precede broader market adjustments.

The broader market context provides important perspective. While headline indices posted impressive gains, market breadth was relatively weak, with many stocks and sectors lagging significantly behind the tech leaders. The S&P 500’s 23.31% gain masks considerable dispersion in individual stock performance.

Looking ahead, market dynamics suggest increased volatility is likely. The sustainability of current AI-driven growth rates faces scrutiny as the technology moves from speculation to implementation. Companies will need to demonstrate that their AI investments can generate profitable real-world applications to justify their elevated valuations.

The commodities market offers an interesting counterpoint, with gold rising 27% to record levels, suggesting some investors are maintaining defensive positions despite the equity rally. This hedging behavior indicates underlying concerns about market stability and inflation risks.

For investors, the key challenge lies in balancing exposure to transformative AI opportunities against valuation and concentration risks. Historical patterns suggest that market leadership eventually broadens or rotates, often accompanied by periods of volatility.