US National Debt Surpasses $36 Trillion: A Critical Analysis

The US national debt’s rapid acceleration signals major economic shifts, with experts concerned about increasing borrowing speed and monetary policy challenges as debt-to-GDP ratios climb to historic levels.

The surge in US national debt beyond $36 trillion marks a significant milestone in America’s fiscal trajectory. This acceleration tells a compelling story about fundamental changes in US economic policy and global financial dynamics.

The pace of debt accumulation has notably quickened. The journey from $34 trillion in early 2024 to $35 trillion took approximately seven months, but reaching $36 trillion required only about three and a half months. This accelerating pattern raises important questions about sustainable debt management.

Several key factors drive this acceleration:

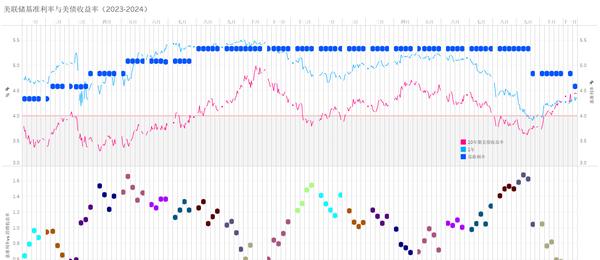

First, the Federal Reserve’s monetary policy stance faces mounting challenges. While the Fed has implemented interest rate adjustments to combat inflation, the massive debt burden creates complex policy trade-offs between economic stability and debt servicing costs.

Second, structural spending pressures continue to mount. Mandatory expenditures like Social Security, Medicare, and interest payments now consume approximately 75% of federal spending, with social insurance programs alone accounting for 44% of outlays. This leaves limited flexibility for discretionary spending adjustments.

The debt situation particularly impacts global financial markets. As the world’s reserve currency issuer, American debt management has far-reaching implications. Japanese, South Korean, and Taiwanese economies, deeply integrated into the US financial system, face potential exposure to American fiscal decisions.

A critical dimension involves the Federal Reserve’s balance sheet management. The Fed’s decisions about Treasury holdings significantly influence market dynamics and interest rates. Recent trends show the Fed reducing holdings while debt issuance increases, creating potential market pressures.

The shifting composition of debt ownership also merits attention. Domestic ownership of US debt has grown to approximately 75%, marking a substantial structural change in the debt market over recent years. This evolution affects both market dynamics and policy flexibility.

Manufacturing policy and economic competitiveness intersect with debt management challenges. The debt trajectory influences America’s capacity to invest in industrial policy, technological innovation, and economic modernization - key factors in maintaining global economic leadership.

The relationship between fiscal and monetary policy grows increasingly complex. Treasury issuance patterns, Federal Reserve policies, and market reactions create intricate feedback loops that influence economic outcomes and financial stability.

Understanding these dynamics requires examining historical parallels, particularly comparisons with other major economies' debt experiences. The Japanese model of sustained high debt with low interest rates offers instructive lessons, though America’s consumption-oriented economy presents distinct challenges.