L3 Autonomous Driving in China: A New Era Begins

Beijing and Wuhan have passed regulations enabling L3 autonomous driving starting in 2025, marking a significant milestone for China’s autonomous vehicle industry. Major automakers have accelerated their preparations as regulations evolve and technology matures.

The autonomous driving landscape in China is undergoing a transformative shift as major cities implement new regulations. In December 2024, both Beijing and Wuhan passed groundbreaking legislation that will permit Level 3 (L3) autonomous vehicles on their roads starting in early 2025. This development follows Shenzhen’s pioneering autonomous driving regulations implemented in August 2022.

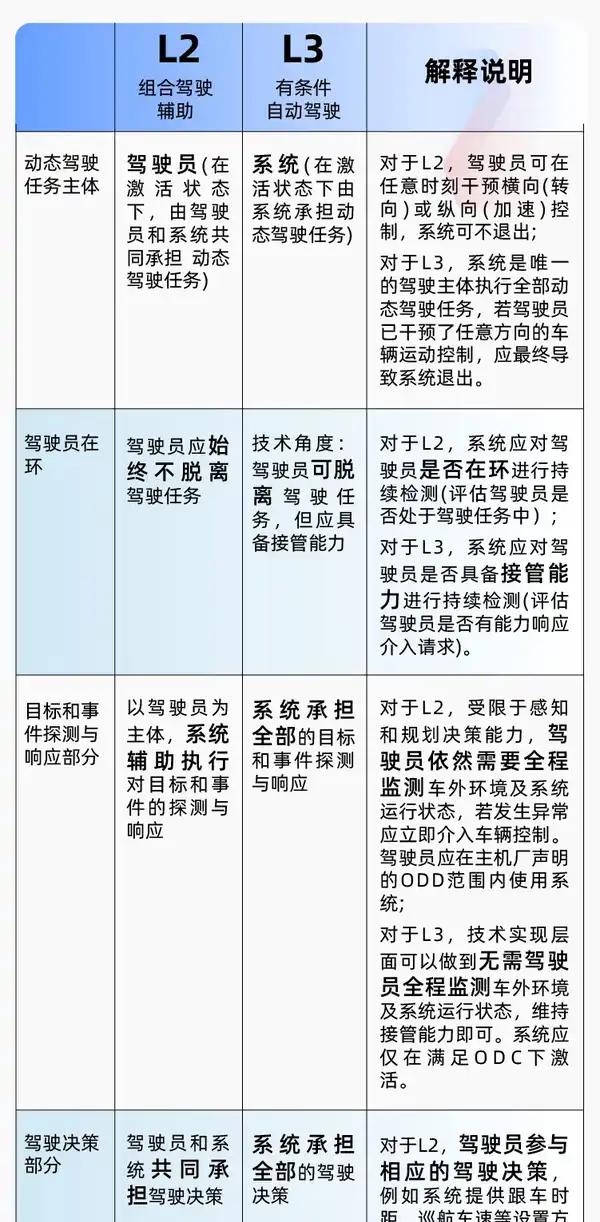

The technological requirements for L3 autonomy are demanding. Unlike L2+ systems, L3 allows drivers to temporarily disengage from driving under specific conditions, though they must remain ready to take control. This capability requires sophisticated hardware including LiDAR sensors, high-performance computing chips, and advanced AI algorithms.

Chinese automakers have made significant investments in preparation. Huawei, in partnership with AITO, plans to launch their S800 model with L3 capabilities in 2025. Other manufacturers including IDEAL Auto and XPeng have also announced L3-ready vehicles. These companies are pursuing different technical approaches, with some favoring pure vision systems while others opt for sensor fusion with LiDAR.

The cost implications of L3 technology are substantial. The liability shifts from driver to manufacturer in L3 mode, leading companies to initially restrict L3 features to premium vehicles priced above 1 million RMB. However, component costs are decreasing rapidly. NOA (Navigate on Autopilot) systems that previously cost 70,000 RMB have dropped to 35,000 RMB, with further reductions expected.

Market penetration of advanced driver assistance systems is growing rapidly in China. Data shows that 55.7% of passenger vehicles sold in 2024 featured L2 or higher autonomous capabilities. Industry experts project this figure could reach 65% by 2025, reflecting strong consumer demand for intelligent driving features.

Safety remains paramount in the development of L3 systems. Companies are implementing redundant sensors and sophisticated fail-safe mechanisms. The operational design domain (ODD) for L3 features will initially be limited to specific conditions like highways in good weather, gradually expanding as technology proves reliable.

The regulatory framework addresses key concerns including accident liability and testing requirements. Both Beijing and Wuhan require extensive road testing and demonstration applications before L3 vehicles can be approved for consumer use. These regulations provide clarity while maintaining high safety standards.

This evolution of autonomous driving in China demonstrates the country’s commitment to leading in advanced automotive technologies. As costs decrease and capabilities improve, L3 features are expected to become increasingly accessible, though initially limited to premium vehicles and specific use cases.