Chinese EV Market Reaches New Heights in November

November 2024 saw dramatic growth in China’s electric vehicle market, with BYD delivering over 500,000 units and emerging players like XPeng hitting milestone deliveries. The data reveals intensifying competition and shifting market dynamics in China’s EV sector.

China’s electric vehicle market demonstrated remarkable momentum in November 2024, with both established and emerging manufacturers posting significant sales growth. This surge in deliveries highlights the increasing consumer acceptance of EVs and China’s growing dominance in the global electric vehicle industry.

BYD continues to lead the pack with exceptional performance, delivering 506,804 vehicles in November, representing a 67.87% year-over-year increase. The company’s cumulative deliveries for 2024 have reached 3.75 million units, maintaining its position as the world’s largest EV manufacturer. Notably, BYD’s overseas sales reached 30,977 units, indicating successful international expansion.

XPeng Motors achieved a breakthrough by delivering over 30,000 vehicles for the first time, marking a 54% year-over-year increase. This success can be attributed to strong demand for their MONA M03 and P7+ models. The MONA M03, priced at 119,800 yuan, secured over 10,000 orders within its first hour of launch, demonstrating robust market reception.

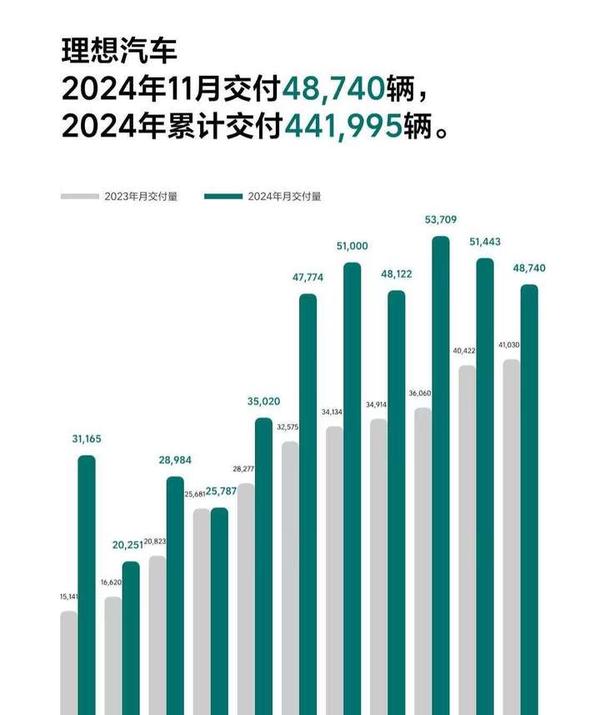

Li Auto maintained its position as the leading new energy vehicle startup, delivering 48,740 units in November, an 18.8% increase compared to last year. The company has maintained steady monthly deliveries above 45,000 units, highlighting their stable market position.

ZEEKR Auto posted impressive growth with 20,575 deliveries, maintaining their seventh consecutive month of deliveries exceeding 20,000 units. This performance underscores the brand’s growing acceptance in the premium EV segment.

Xiaomi Auto’s SU7 continued its strong market presence with over 20,000 deliveries for the second consecutive month, demonstrating the tech giant’s successful transition into the automotive sector. The company appears well-positioned to achieve its annual target of 130,000 deliveries.

AITO, backed by Huawei, reached another milestone with 11,579 deliveries in November, showing a remarkable 180% year-over-year growth. This performance reflects the growing influence of technology companies in the automotive sector.

This robust growth across multiple manufacturers indicates a maturing EV market in China, with increasing competition driving innovation and improved product offerings. The market’s evolution is particularly noteworthy as traditional internal combustion engine vehicles continue to lose market share to electric alternatives.

The success of China’s EV manufacturers extends beyond domestic markets, with several companies reporting significant growth in international sales. This global expansion represents a shift in the automotive industry’s power dynamics, with Chinese manufacturers increasingly competing with established international brands.

These November results suggest that China’s EV market is not only growing but also diversifying, with different manufacturers finding success in various market segments. The continued strong performance across multiple brands indicates sustained consumer confidence and the effectiveness of China’s EV-friendly policies.