China's Stock Market Rally: Policy Support Signals Growth Momentum

A significant surge in Chinese assets occurred after a key political meeting announced supportive monetary and fiscal policies for 2024, emphasizing consumption, market stability, and risk prevention.

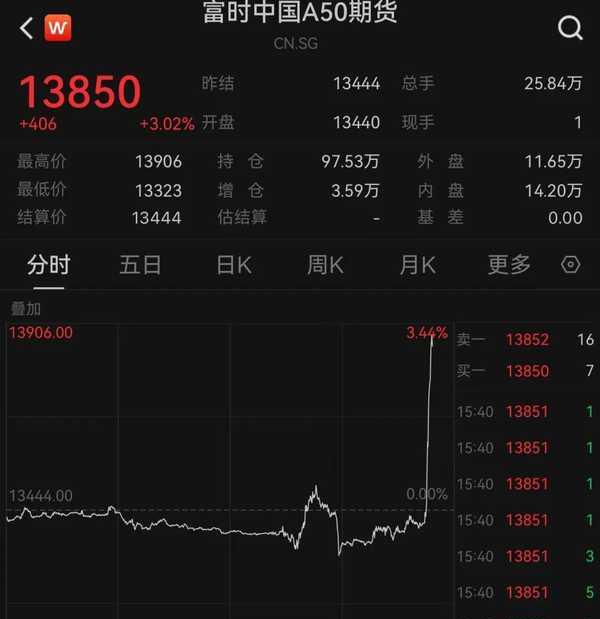

China’s financial markets experienced a notable upswing on December 9, with Hong Kong’s Hang Seng Index climbing 2.76% and the Hang Seng Tech Index surging 4.3%. This dramatic market response followed a crucial meeting of China’s top leadership, which outlined economic priorities for 2025.

The rally was primarily driven by three key policy developments. First, China’s leadership committed to implementing “more proactive fiscal policies and appropriately accommodative monetary policies” - marking the first time in 14 years that such explicitly accommodative language has been used. This signals a potentially significant shift in China’s monetary stance.

Second, the meeting emphasized stabilizing both the real estate market and stock market, demonstrating unprecedented direct attention to capital market stability. The focus on preventing systemic risks while maintaining market confidence represents a clear commitment to supporting investor interests.

Third, the leadership highlighted expanding domestic demand and boosting consumption as key priorities. This consumer-focused approach, combined with pledges to enhance investment efficiency and promote technological innovation, suggests a comprehensive strategy to drive economic growth.

Financial stocks led the market surge, with securities firms experiencing particularly strong gains. Companies like China Merchants Securities rose 10%, while other major brokerages saw increases of around 5%. Property developers also rallied significantly, with some firms gaining over 10%, reflecting optimism about sector stability.

The market response extended beyond mainland China, with China-focused ETFs trading overseas showing substantial gains. The Direxion 3x leveraged China ETF surged 14% in night trading, indicating strong international investor confidence in China’s economic outlook.

These policy signals suggest China’s leadership is taking decisive action to support economic growth and market stability. The emphasis on domestic consumption, technological innovation, and financial market stability indicates a comprehensive approach to economic management that could shape market dynamics well into 2024.

The meeting’s outcomes demonstrate China’s commitment to maintaining economic momentum while managing risks, with particular attention to preventing external shocks and supporting key sectors. This balanced approach, combining growth stimulus with risk management, appears designed to foster sustainable economic development while maintaining market stability.