China's Personal Pension System: A New Era in Retirement Planning

Starting December 15, China expands its personal pension system nationwide, marking a significant shift in retirement planning. This article analyzes the system’s design, implementation challenges, and implications for different income groups.

China’s nationwide rollout of the personal pension system represents a transformative approach to retirement planning, building upon a three-year pilot program across 36 regions. This expansion reflects China’s response to its rapidly aging population and the need to diversify retirement funding sources.

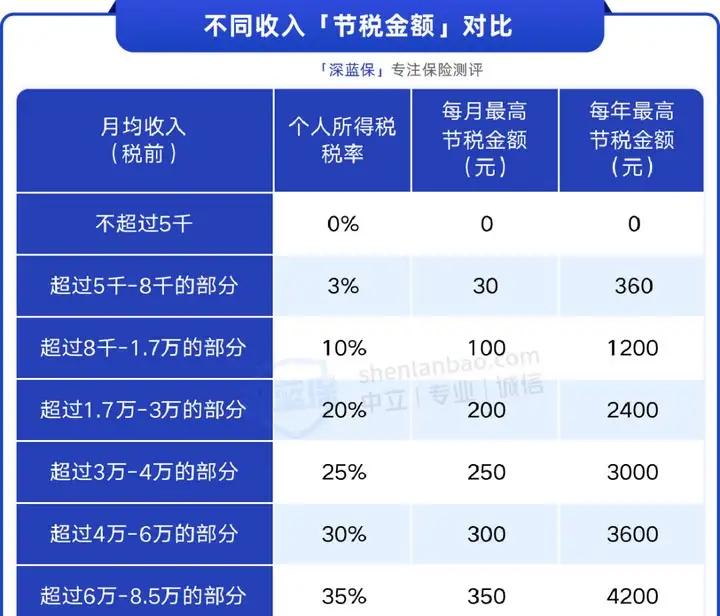

The system allows individuals to contribute up to 12,000 yuan annually to their personal pension accounts. However, its effectiveness varies significantly across income groups. For those earning over 8,000 yuan monthly, the tax benefits become meaningful, offering deductions that increase with income brackets. Below this threshold, the tax advantages are minimal or non-relevant.

A critical aspect often overlooked is the system’s stringent withdrawal conditions. Funds can only be accessed under specific circumstances: reaching retirement age, complete loss of working ability, moving abroad permanently, severe illness, unemployment insurance collection, or receiving minimum living allowance. These conditions create significant limitations for emergency access to funds.

The investment options within the system include bank savings products, commercial pension insurance, and FOF (Fund of Funds) products. Recent performance data shows mixed results, with some FOF products experiencing losses exceeding 10%. This volatility highlights the importance of careful product selection and risk assessment.

The retirement age threshold presents another consideration. With China recently implementing delayed retirement policies (men at 63, women at 55/58), future adjustments may further restrict access to these funds. This aligns with global trends, as many developed nations have retirement ages between 65-68.

For high-income earners, the system offers meaningful tax benefits and can serve as part of a diversified retirement strategy. However, for the majority of China’s workforce, particularly those with monthly incomes below 8,000 yuan, alternative retirement planning methods may be more suitable.

The system’s success largely depends on future policy refinements, particularly regarding withdrawal conditions and investment options. A key challenge lies in balancing accessibility with long-term savings preservation.

Beyond tax benefits, individuals should consider their overall retirement planning strategy. The personal pension system should be viewed as one component of a broader approach that might include traditional social security, commercial pension insurance, and personal investments.

For optimal retirement planning, individuals should evaluate their income level, risk tolerance, and long-term financial goals before participating in the system. This comprehensive assessment helps ensure alignment between retirement needs and available financial tools.