China's December 2024 CPI: Economic Implications and Structural Challenges

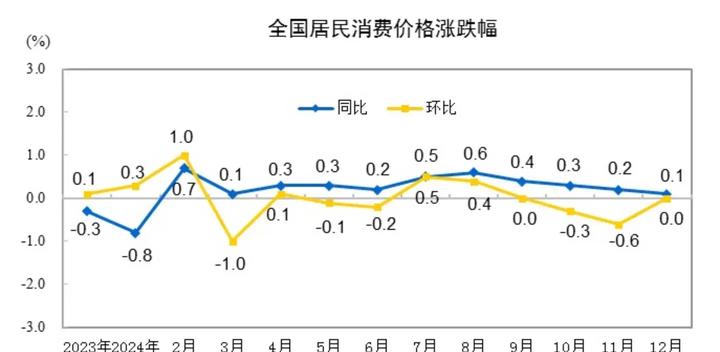

China’s December 2024 Consumer Price Index (CPI) rose 0.1% year-on-year, while the full-year CPI increased 0.2%, reflecting persistent deflationary pressures and structural economic challenges amid policy stimulus efforts.

The latest CPI data from China reveals complex dynamics in the world’s second-largest economy. The modest 0.1% year-on-year increase in December 2024, despite significant policy stimulus measures including approximately 150 billion yuan in consumption subsidies during Q4, points to deeper structural challenges beyond cyclical factors.

The data shows notable divergences across different sectors. Food prices declined by 0.5%, while non-food prices increased by 0.2%. Within these broad categories, pork prices experienced significant volatility, showing high year-on-year growth despite recent monthly declines. Fresh vegetable prices dropped sharply due to unusually warm winter conditions, while beef prices continued their downward trend due to supply-demand mismatches.

Core inflation, excluding food and energy prices, maintained an upward trajectory with a 0.4% year-on-year increase. This figure, while positive, remains historically low and reflects persistent weakness in domestic demand. The services sector showed relative resilience with a 0.5% price increase, though this too remains below pre-pandemic levels.

The structural nature of China’s current economic challenges becomes apparent when examining consumer behavior patterns. Middle-income households, representing about 60% of the population, account for only 31% of total household disposable income. This income distribution imbalance significantly constrains consumption growth potential.

Looking forward, several factors will likely continue to influence price trends:

- International energy and commodity prices

- The effectiveness of domestic consumption stimulus measures

- The ongoing adjustment in the real estate sector

- The evolution of supply chain dynamics

- Income distribution reforms aimed at strengthening middle-class consumption power

The modest CPI figures, particularly in the context of significant policy support, suggest that China’s transition toward a consumption-driven growth model faces considerable challenges requiring sustained structural reforms rather than just cyclical policy responses.

These developments carry implications beyond China’s borders, particularly for global trade patterns and inflation dynamics. As China continues to navigate these challenges, the effectiveness of its policy responses will be crucial for both domestic economic stability and global economic prospects.