A50 Index Inclusion Debate: Cambricon and SERES Stir Controversy

The inclusion of Cambricon and SERES in the SSE 50 Index has sparked heated debate among investors, highlighting concerns about index compilation methodology and market representation in China’s A-share market.

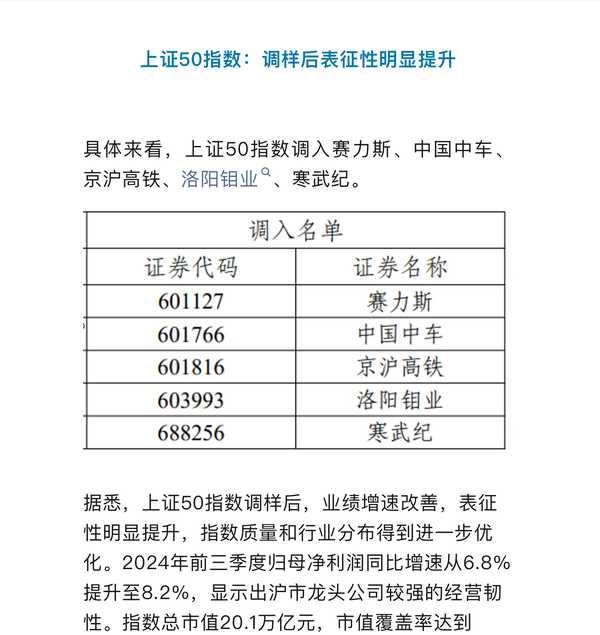

The recent announcement of Cambricon’s inclusion in China’s SSE 50 Index has ignited intense discussion in the investment community. As one of China’s leading AI chip companies, Cambricon’s addition to this prestigious index raises important questions about market valuation and index composition criteria.

A closer examination of Cambricon’s financials reveals concerning patterns. The company’s revenue has stagnated around 7 billion yuan between 2021-2023, with consistent annual losses averaging 9 billion yuan. More troublingly, revenues for the first three quarters of 2024 dropped to just 1.85 billion yuan, ranking 4,865th among 5,118 listed companies in China’s A-share market. Despite these fundamentals, Cambricon maintains a market capitalization of approximately 234 billion yuan.

The stark contrast between Cambricon and its international peers further highlights these valuation concerns. While Nvidia generates annual profits of around $30 billion, Cambricon continues to operate at a loss. Industry experts point out that AI chip development requires massive capital investment - even a 10 billion yuan investment barely scratches the surface of what’s needed for competitive R&D.

The inclusion criteria for the SSE 50 Index primarily considers market capitalization and trading volume, rather than fundamental business performance. This mechanical approach has drawn criticism from market participants who argue it could mislead investors, particularly given that passive funds tracking the index manage nearly 200 billion yuan in assets.

This situation reflects broader challenges in China’s stock market. The index inclusion methodology’s focus on market value over business fundamentals may incentivize speculation rather than value investment. Some analysts argue this contributes to the market’s long-term underperformance, with the main index hovering around 3,000 points for over a decade.

The debate extends beyond Cambricon to questioning whether high-growth but unprofitable companies belong in a blue-chip index traditionally associated with stable, profitable enterprises. Critics argue that including such volatile stocks could undermine the index’s credibility as a benchmark for China’s leading companies.

This controversy has sparked calls for reform in index compilation methodology to better reflect business fundamentals and long-term value creation. The outcome of this debate could influence future discussions about market structure and investment standards in China’s evolving financial markets.